Carney includes billionaires in “middle class” tax cut pledge

Carney’s cancelled capital gains tax hike will save $1.8B in 2027-28 for 0.16% of tax filers earning an average $1.2M a year.

No one’s ever accused Mark Carney of being middle class. But the former Toronto investment banker’s proposed “middle class tax cut” includes ultra-high income earners like him.

The Liberal leader this morning launched his campaign promising a “middle class tax cut” that gives top benefit to millionaires and billionaires.

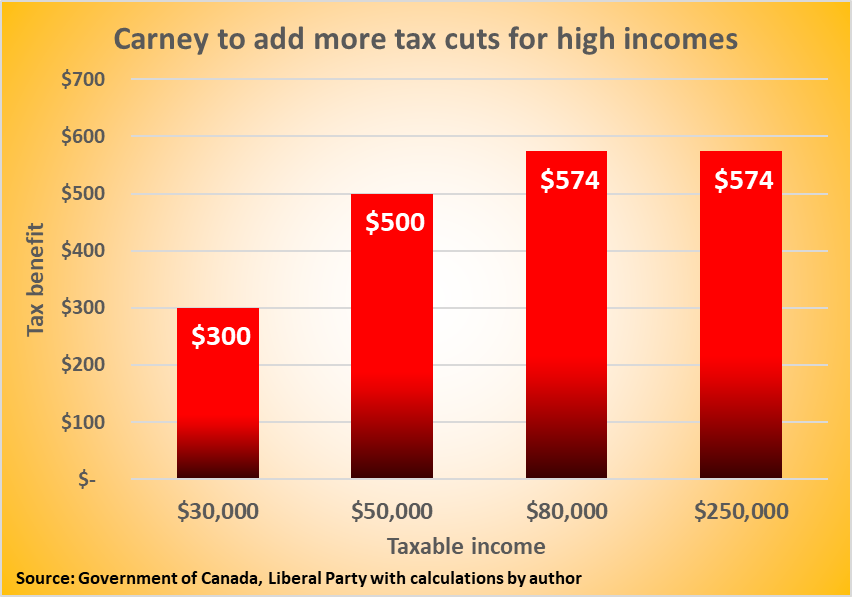

Carney’s plan would reduce the tax rate of the first tax bracket by one point, from 15 to 14 per cent.

That generates a $574 benefit to anyone with a taxable income over $57,375 and right up to the top income earner. Those earning less than $57,375 would get a smaller benefit.

Unlike Trudeau in 2015, no high income offset with Carney

In 2015, Justin Trudeau also promised “middle class” tax cut, but one that came with an off-setting tax increase on income over $250,000. That off-set cancelled any benefit once income exceeded about $263,000.

But with no off-set in Carney’s plan, even the highest income earners in Canada are included in Carney’s “middle class” tax cut. The maximum $574 would be paid to Galen Weston, Chip Wilson, the Irvings or the Thompson family. And Mark Carney.

Tax payable on a taxable income of $30,000 would be reduced by $300 and tax payable on $50,000 would fall $500.

While anything is helpful for low-income Canadians, bolder steps like the national dental care program deliver much more impact, saving a low-income family of four $1,809 a year, according to 2024 budget documents.

Carney kills planned tax hike on capital gains over $250,000 a year

Today’s pledged tax cut for even the richest Canadians comes after Carney cancelled Trudeau’s plan for two thirds of capital gains over $250,000 a year to become subject to income tax, up from half. Half of amounts up to $250,000 a year would continue to go tax-free.

Capital gains are the amount earned from buying then selling capital assets, such as company stock, and are treated differently than employment income in tax law.

In recent research paper in Policy Options, tax experts using 2019 tax filer information found the entire benefit of Carney’s cancellation would flow to just 46,705, or 0.16 per cent, of tax filers. That group had an average income of $1,183,157 in 2019.

For 99.86 per cent of Canada’s 29 million tax filers, there would be no benefit from Caney’s tax cancellation.

In 2027-2028, cancelling capital gains changes is projected to be worth $1.8 billion to that very small pool or investors earning more than $250,000 a year in capital gains. The amount saved is projected to rise to $2.3 billion in 2028-29.

Carney will get “middle class tax cut,” but benefit from cancelling capital gains unclear

On starting at the Bank of England in 2013, Carney was being paid $1.4 million a year. After seven years later, Carney left to join Brookfield Asset Management, an investment bank with $1 trillion in assets that owns everything from privatized hospitals to local utilities and real estate.

Carney served as Brookfield board chair, resigning January 16, 2025.

Last week, a US corporate filing by Brookfield Asset Management shows Carney and two other executives together earned $4 million in salary, $3.5 million in cash bonuses and $67,439 paid to retirement savings contributions and Brookfields’ executive medical program.

The $7,567,439 total, if averaged between the three executives, would be $2,522,479 each.

Despite his ultra-high income, Mark Carney has included himself in his “middle class tax cut.”

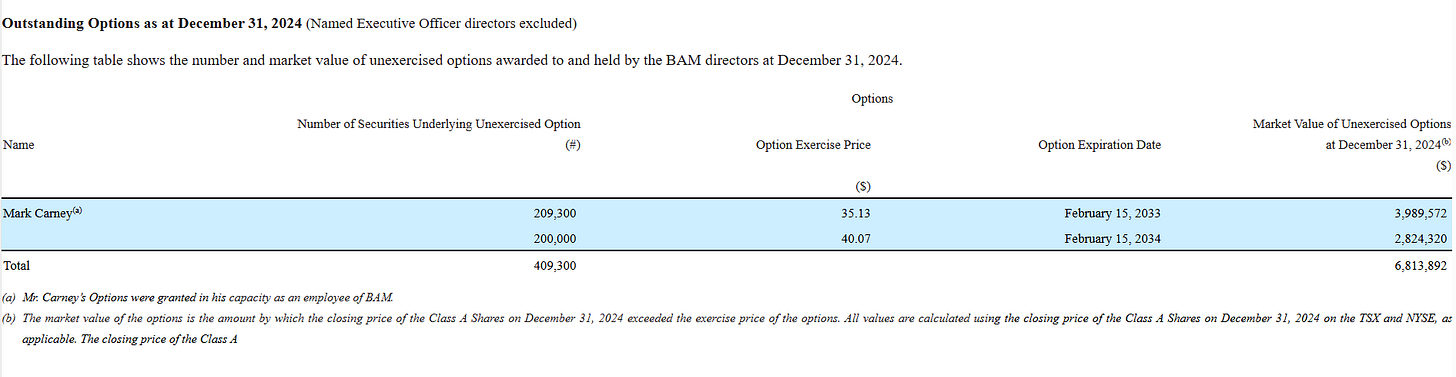

Brookfields’ 10-K filing also shows Carney held 409,300 Brookfield share options on December 31, 2024. On Friday’s close, Brookfield stock traded at $53.65. But Carney’s options let him buy those shares for the deeply discounted price of $37.54.

If Carney exercised any share options on Friday, he would’ve earned $16.11 per share, the difference between the $53.65 market price and the $37.54 option price. If he exercised all his 409,300 share options on Friday, he would have earned $6,598,823.

While stock option income is usually treated as a capital gain, and therefore only half taxed, earnings from stock options received as employment compensation are employment income and must all be included as income. However, the employee stock option benefit deduction parallels the capital gains inclusion rate, delivering the same effect, a detailed topic for a future date.

This is a problem but Trump made Carney more appealing despite being backed by Trudeau and the establishment. The NDP really sidelined themselves during this entire period.

I see that the Conservatives announced a cut to the lowest tax bracket from 15% to 12.75%. Would this not be the same as what you have outlined in your article i.e. giving the top income earners a tax break as well as the lowest bracket earners? However it would be an even greater break than the Liberals plan.