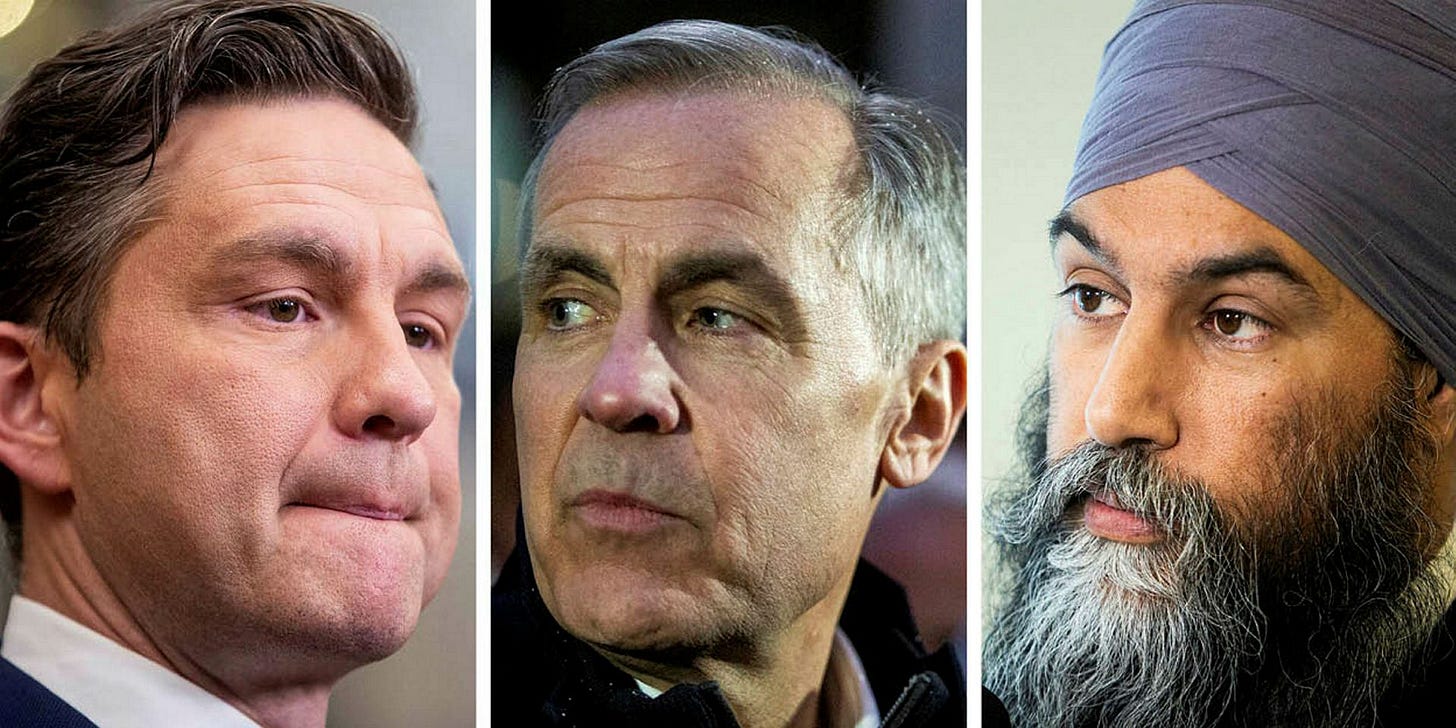

Poilievre copies Carney tax cut plan helping billionaires, opening space for Singh

Carney's "middle class" tax cut and Poilievre's "tax cut for workers" would both give bigger benefit to Galen Weston than a $60,000 a year worker. Both seem...sneaky.

Conservative leader Pierre Poilievre says Liberal leader Mark Carney is “sneaky,” but this morning he took the Liberal leader’s sneaky tax policy and made it 2.25 times sneakier.

In the last two days, both leaders have issued similar tax cut polices, neither of which are targeting tax relief on those they claim to be targeting for help.

On Sunday, Carney pledged a one point tax cut to the first income bracket, a cut he claimed was “for the middle class” but which would deliver the maximum benefit to billionaire families and million-dollar investment bankers and absolutely nothing for almost 10 million tax filers.

And today, not to be outdone, Conservative leader Pierre Poilievre offered exactly the same Carney tax plan except with a larger 2.25 point tax cut to the first income bracket. Poilievre claimed his cut was for “workers,” but it would send an even bigger benefit to millionaires and billionaires than Carney’s plan.

NDP leader Jagmeet Singh hasn’t touched on tax policy yet. But a proposal would likely be well-received if it honestly targeted help on those the leader said he was targeting and not giving more tax relief to Galen Weston than the average Canadian earning $60,000.

Carney, Poilievre both didn’t mention the price

The dueling tax cuts also give Singh a lot of fiscal room to present better ways to spend money.

David Macdonald, senior economist with the Canadian Centre for Policy Alternatives, estimates Carney’s proposal would cost $5.4 billion a year and Poilievre’s version would cost $12.2 billion a year.

In contrast, a federal report released last week estimated Singh’s dental program will cost an average $2.6 billion a year over the next five years.

Carney, Poilievre both didn’t target the people they said

Both Carney and Poilievre could easily have designed a tax policy exclusively targeting its tax benefit onto the groups they claim they are targeting.

They could have put a cap on the benefit at, say, $150,000 annual income. Or tied it to T4 employment income and excluded investment income.

That’s what Trudeau did in 2015 when he offered a “middle class” tax cut with an off-setting tax for incomes over $250,000.

But Carney and Poilievre decided against that, then both leaned into characterizations that were inaccurate and deceptive. Even sneaky, you might say.

The plans from Carney and Poilievre would give more tax relief to Galen Weston than a worker earning $60,000, according to the analysis by CCPA’s Macdonald.

Neither tax cut is fully phased in until taxable income (income after deductions, etc.) passes $57,375, then delivers the maximum benefit to everyone above that, including millionaires and billionaires.

The benefit becomes more loaded against low income workers because many already receive tax credits to partially offset income tax. For these workers, a tax reduction triggers a tax credit reduction. Macdonald estimates that of Canada’s 32 million tax filers, 10 million will receive no benefit from either plan.

Carney, Poilievre on same side against capital gains change

It’s not the first time Carney and Poilievre have been on the same side of tax changes.

During his leadership campaign, Carney copied Poilievre’s vow to cancel an increase to the inclusion rate for capital gains over $250,000 scheduled by Justin Trudeau.

Capital gains are the amount earned from buying then selling a capital asset, such as company stock. Much of that income is tax-free.

Trudeau planned for two thirds of capital gains over $250,000 a year to be included for income tax, up from half. Half of amounts up to $250,000 a year would continue to go tax-free. Carney has cancelled the Trudeau plan, saving billions for the tiny group with capital gains over $250,000 a year.

In recent research paper in Policy Options, tax experts using 2019 tax filer information found the entire benefit of Carney’s cancellation would flow to just 46,705, or 0.16 per cent, of tax filers. That group had an average income of $1,183,157 in 2019.

For 99.86 per cent of Canada’s tax filers, there would be no benefit from Carney’s cancellation, according to the report.

In 2027-2028, canceled capital gains changes are projected to be worth $1.8 billion to that very small pool or investors earning more than $250,000 a year in capital gains. The amount saved is projected to rise to $2.3 billion in 2028-29.

Please explain. I haven’t calculated my own taxes since I became partially sighted and can’t tell a zero from an 8 so maybe things have changed. I thought the first level was the same income amount and percentage tax rate for everyone, so everyone would reap the same total benefit from a 1% discount on the first level, except for people who made less than that. I heard figures of $460-$840 ish. Everyone declaring an income above that first level and second or third levels as last year would pay the same percentage as last year on those portions of their declared incomes. Carney’s cut would benefit anyone paying taxes but no further decrease for declarable income above that.

However, Poilievre said nothing about levels in his tax cut announcement on Sunday, but just that everyone would get a $2.25 tax cut. Let me say that 2.25% is a whole lot less benefit for someone declaring $20,000 than for someone declaring $2,000,000. Just add 3 zeros.

Please NDP go after Pierre and the Tories. Take votes away from them instead. I prefer to avoid vote splitting as seen in the recent Ontario provincial election.