Ontario manufacturing down 9% from May 2023 peak, led by auto and steel

Manufacturing jobs are down 13,000 from June 2018, Trump election adds uncertainty to massive public EV supply chain investments, premier focusing voters on bike lanes

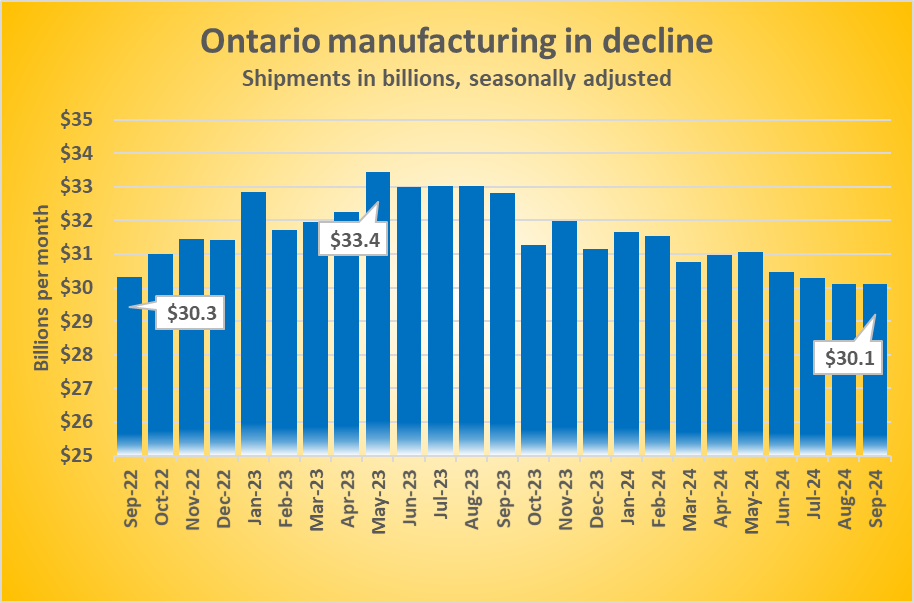

Ontario manufacturing shipments continued their decline in September, falling to $30.1 billion, according to seasonally adjusted data from Statistics Canada released Friday.

From a peak of $33.4 billion in May, 2023, Ontario manufacturing shipments are down $2.9 billion, or 8.9 per cent.

Manufacturing is important to Ontario’s export-driven economic growth. Shipments haven’t been lower since January 2022.

Auto and steel lead manufacturing decline

The biggest hit has come in the auto industry. Motor vehicle manufacturing is down 27 per cent from a $5.4 billion peak in July 2023 to $4.0 billion in September.

Auto parts manufacturing has fallen 16 per cent, from a $3.1 billion peak in July 2023 to $2.6 billion in September 2024.

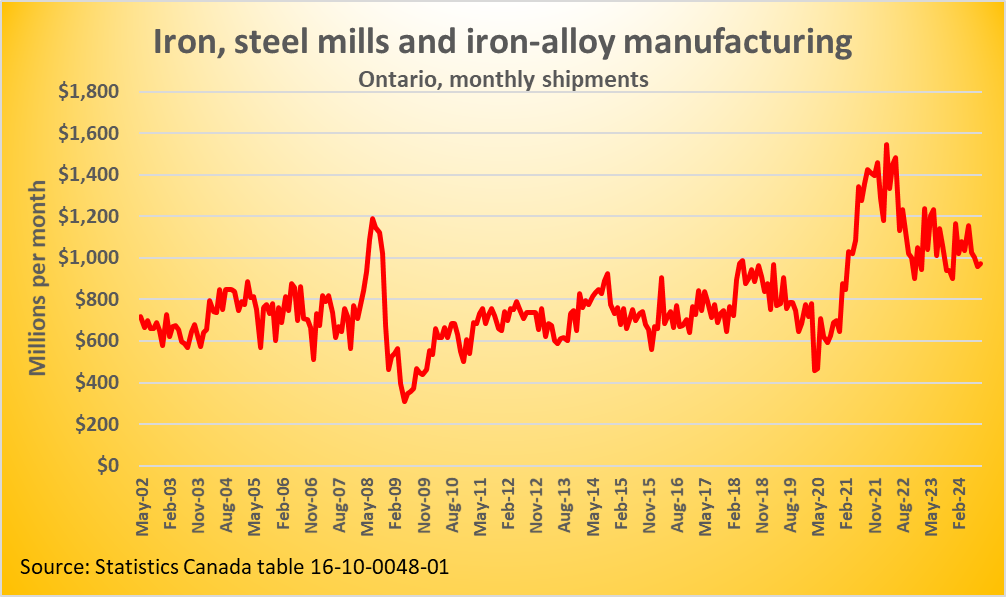

Steel manufacturing has also recently tumbled, falling 34 per cent from a peak of $1.5 billion in June 2022 to $970 million in September 2024. However, steel remains higher than in more of the 20 years before the 2022 peak (see chart, below).

Canada was the world’s sixteenth largest steel producer, by volume, in 2023 and the fourteenth largest vehicle manufacturer in 2022. according to international industry associations.

Trump’s impact on Ontario EV investments unclear

Ontario has lost over 13,000 manufacturing jobs since the June 2018 election, when premier Doug Ford gave a “guarantee” he’d create 300,000 manufacturing jobs.

And now the sector, and the billions of public dollars spent rebuilding auto supply chains around electric vehicle production, faces more uncertainty due to the re-election of US President Trump, who opposed EV purchase incentives during his campaign.

Some have argued the influence of Elon Musk, owner of EV manufacturer Tesla, could cause Trump to reverse course and keep EV incentives. But others believe ending the incentive plan would help Tesla, already profitable, secure dominance over the American EV market by increasing the investment required by his EV competitors to reach profitability.

However the situation turns, investors are betting Tesla will come out a winner. Telsa share price is up 60 per cent since Labour Day, rising from $210 USD on September 3, 2024 to $336 USD yesterday.

None of Canada’s EV battery production appears to be currently tied into Tesla’s supply chain. Tesla’s biggest battery partner, South Korea’s LG, has received billions to set up production in Ontario. But the protect is in partnership with Stellantis, owner of big car brands Chrysler, Dodge, Jeep, Fiat, Alfa Romeo, Maserati, Renault, Citroën, Peugeot and others competitors to Tesla.

Ontario premier focusing attention elsewhere

Ontario’s manufacturing decline and new uncertainty comes as the province’s approach to housing fails to spur construction starts, costing jobs and increasing the costs for renters and house-seekers.

Retail sales are below a 2022 peak, the average wage has fallen the last two months and unemployment has been higher than the national rate for most of the past five years. On each metric, Ontario is heading in a different, and worse, direction than the rest of Canada.

While economic clouds continue to gather over Ontario, the province’s premier appears to believe he will win a third term by misdirecting voters onto controversy he has created about removing bicycle lanes from some Toronto streets.