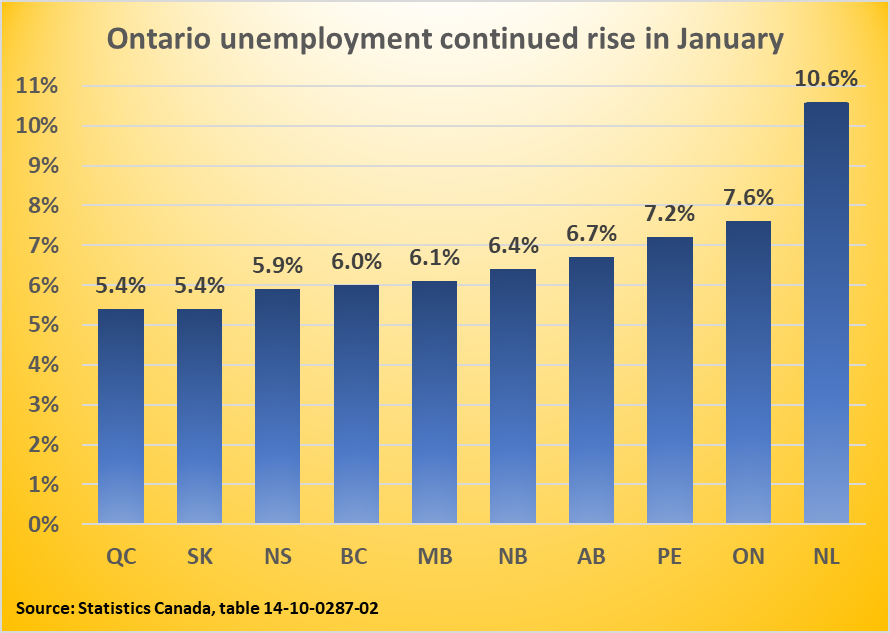

Ontario jobless rate up again even as national rate declines

Rising unemployment comes as Doug Ford campaigns as “job protector”

Once a magnet attracting job-seekers from across Canada, Ontario’s economy continues to sputter even as premier Doug Ford proclaims himself the “jobs protector” in the province’s current election campaign.

Ontario’s seasonally adjusted unemployment rate ticked up 0.1 percentage point in January, accord to Statistics Canada’s Labour Force Survey, hitting 7.6 per cent. Newfoundland and Labrador was the only province to have a higher unemployment rate and the only other province where the jobless rate rose in January.

The national unemployment rate fell 0.1 points to 6.6 percent, seasonally adjusted.

Except for one month in 2023, Ontario’s seasonally adjusted jobless rate has not been better than the national rate since April 2020, 58 months ago.

Construction jobs weak as housing targets missed

Employment in construction remains below levels of summer 2023 held back by a housing industry recession the took hold after unchecked speculative run-up created a market explosion in spring 2022.

To reach housing goals, Ontario has set a housing starts target at a pace of 12,500 unit starts per month, which has never met. December housing starts were only 44 per cent of target.

Despite poor construction sector jobs performance, several construction unions have endorsed Doug Ford for re-election, many of which have received significant amounts of public money.

Retail jobs down amid affordability crisis

About 40,000 jobs in retail sales have disappeared since the Christmas sales season of 2021 before an affordability crisis became to set up.

Housing asking rents and sales prices peaked in 2022, leaving less income available for retail purchasing.

Though retail sales are at new peaks in the rest of Canada, Ontario retail sales remain below levels of spring 2022.

Auto plant sell-off symbol of industry struggles

Jobs in manufacturing are also below a recent peak as the auto industry, which anchors many other manufacturing businesses, faces new impacts from the 2018 CUSMA renegotiation and the on-going threats from U.S. President Donald Trump.

A counter-strategy funded with up to $52.5 billion in federal and provincial money aimed has leveraged $46.1 billion in private investment to refound the sector around electric vehicle production. But the effectiveness of these investments in now in doubt due to cancellation of EV purchase incentives by the new U.S. Administration.

A stark symbol of the jobs challenge made headlines as Linmar, a Guelph, Ontario-based auto parts company, listed for sale a newly-constructed EV parts plant in Welland before it had built a single part.