Industrial carbon levy packs bigger punch at lower price than consumer tax, CCI reports finds

A new data-driven mainstream debate over the most effective policy path could sideline the small minority of denialists and do-nothings who've tried to shut down all discussion.

New data on the payoff from various climate policies suggests a stronger push on the industrial carbon levy might be a more efficient path forward.

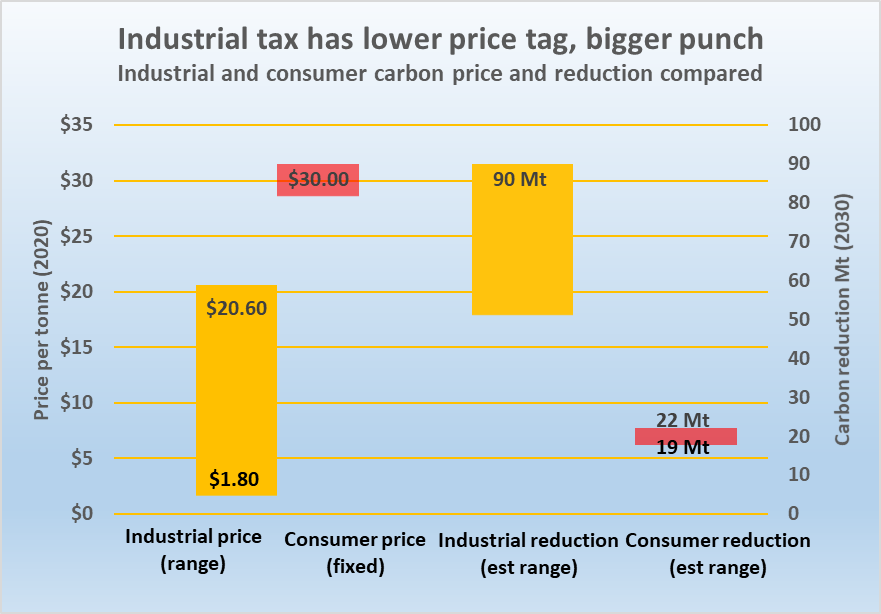

The industrial carbon levy will have cut at least 2.4 and as much as 4.7 times more carbon emissions in 2030 than the consumer carbon tax, according to an analysis by the Canadian Climate Institute published this spring.

And that bigger result comes despite an industrial pricing system that has been shot-though with loopholes, resulting in an industrial carbon price a fraction of the amount levied on consumers, the CCI has also found.

The new data on the actual results of industrial and consumer pricing — and the various regulatory approaches — gives the opportunity to adjust policies to make them more effective and efficient.

And a new data-informed public debate around that adjustment may help advance the political narrative past the pointless and frustrating battles with fringe groups of recent years, forward to a fruitful discussion among mainstream Canadians.

Industrial levy cuts 2.4 to 4.7 times more carbon than consumer tax

Without current provincial and federal climate policies Canada’s annual carbon emissions would climb to 775 in 2030 according to the CCI report. But policies already in effect will cut annual emissions by 226 Mt to 586 Mt in 2030, the report projects.

The largest single policy contributing to that 226 Mt cut is the industrial carbon levy, which will remove between 53 and 90 Mt of the 226 Mt reduction or at least 20 and up to 48 per cent of the total emissions cut.

The industrial levy is projected to have between 2.4 and 4.7 times more effect than the consumer carbon levy.

The consumer tax may not even be the second or third largest contributor to the 2030 emissions cut. Emission caps on the oil and gas industry may drive up to 34 per cent (77 Mt) of the reduction while methane regulation may cause up to 21 per cent (41 Mt) of the reduction.

However, because these two approaches are not yet fully implemented, the CCI report assigns a wide range to their outcomes. Caps may cut as little as seven (16 Mt) while methane regulation could come in as low as one per cent (3 Mt). The strength of the outcomes heavily depends on the firmness of the federal government.

The consumer carbon price is expected to cut 19 to 22 Mt of emissions, or about nine per cent of the total, according to the CCI report

Industrial levy more effective even at much lower cost

A 2020 report from CCI (then known as the Canadian Institute for Climate Choices) found the big reductions driven by the industrial levy were achieved at a fraction of the cost levied on consumers.

The consumer tax currently prices carbon at $85 per tonne with the price increasing $15 each year until it doubles to $170 in 2030.

In contrast, CCI found the carbon price paid by companies ranged from $1.80 to $20.60 per tonne in 2020. SunCor, the largest emitter in the oil and gas sector, paid just $2.10 per tonne, one-fourteenth the price paid by consumers at that time.

While the carbon pricing system was being developed, lobbying effort by oil, gas, mining and coal companies and trade associations intensified. Registered lobbyists chalked up over 1,800 contacts with federal government politicians, political staff and bureaucrats in 2015/16, an 73 per cent increase from the year previous. In 2016/17 there were 1,601. The year following, after the pan-Canadian climate framework was published, contacts dropped to just 325.

The resulting industrial pricing system is riddled by exceptions, exemptions and carve-outs with much of the hard lifting being pushed onto the consumer levy. The CCI report found 84 per cent of industrial emissions were exempt from any carbon levy.

But the CCI’s 2020 and 2024 data reports also shows, despite loopholes, the industrial carbon levy packs a far bigger punch against climate change at a much lower price tag, creating the opportunity to fine-tune and fix the system. Or at least to debate what’s best.