Doug Ford stoked housing prices, then crashed them, leaving economic destruction

The damage from Ford's housing failure can be seen in lower retail sales, higher unemployment and slumping average wage -- while other provinces prosper.

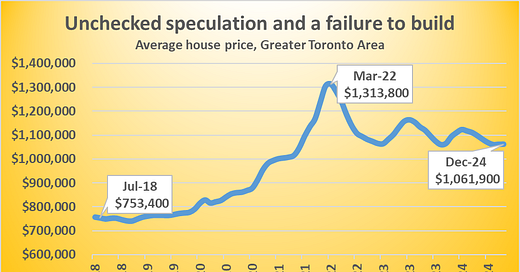

The average home price in the Greater Toronto Area surged 74 per cent after the election of the Doug Ford PC government in 2018, and has now collapsed 19 per cent since the price explosion in March 2022, according to Canadian Real Estate Association data released January 15, 2025.

The CREA’s benchmark average house in the GTA had a massive run-up of $556,000 from about $750,000 in 2018 to over $1,310,000 in 2022, then exploded into a $250,000 price melt-down over the past two years.

Prices began their melt-down the month the Bank of Canada increased its policy interest rate to 0.50 per cent from 0.25 per cent, where it had been for about two years. The Bank increased rates a further 0.50 percentage points to 1.00 per cent in April, 2022. The policy rate reached 5.0 per cent in July 2023.

Failing to tame speculation amplified economic damage

Central bank rate hikes always deliver an economic sting. But Doug Ford’s failure to control speculation and build housing supply made the sting more painful.

Unchecked speculation and a failure to build was met with unprecedented — and completely predictable — housing market demand as ultra-low interest rates from 2020 to 2022 qualified many more people for mortgages.

Prices soared. Driven by a fear of missing out, renters scraped together what they could to jump into home ownership. They paid big prices and took on big debt, leaving less money to spend in local businesses.

With so many Ontarians having less money in their pocket, Statistics Canada retail sales data now shows Ontario consumers spent 2.7 per cent less in November 2024 than June 2022. Yet in the rest of Canada, retail sales are at new records, 4.1 per cent higher than June 2022.

Rampant housing speculation was centred on Toronto, where retail sales are down 3.5 per cent from June 2022. But the economic effects have oozed out across most of southern Ontario.

Echoes of the housing explosion continues to ripple out

And the damage from Doug Ford’s high household debt isn’t over. Hundreds of thousands of mortgages originally contracted at ultra-low interest rates in 2020 will come open for renewal this year. Interest rates have fallen from their peak, but at 3.25 per cent, Canada’s policy interest rate is still much more expensive than the 0.25 per cent rate from 2020 to 2022. Hundreds of thousands of households are going to be paying more, leaving less for spending in the local economy.

Doug Ford’s failure to build housing and control speculation isn’t the only economic problem facing Ontario: manufacturing communities that built things have been neglected for a focus on money-making from Toronto real estate speculation.

The result is Ontario now has an unemployment higher than the national rate and an average wage falling behind British Columbia, Alberta and Quebec, Canada’s wage leaders. Once the economic anchor of Canada, Ontario is now a have-not province received equalization money from the federal government.

Doug Ford let speculation run amok while others acted

While Ontario Premier resisted calls to control speculation and spur building, other provinces took action. The result has been more moderate price increases and less economic damage.

British Columbia tamped down speculative pressures with a provincial speculation and vacancy tax, a foreign buyers tax, a higher transfer tax on properties over $3 million, and a crack-down on unnamed investors using housing — especially condo pre-sales — for speculation and possible money laundering. Doug Ford recklessly took none of these steps.

B.C.’s speculation and vacancy tax, introduced in 2019, supplemented Vancouver’s housing speculation tax. The owner of a vacant property is taxed between 0.5 and 2.0 per cent of the property’s assessed value, which would add $20,000 to the tax but of a foreign owner sitting on a vacant $1 million house. An independent review found the tax pushed 20,000 housing units into the market in its first year.

While Toronto and Ottawa in 2022 instituted a one per cent vacant home tax, no action was taken by Doug Ford.

B.C. has also taken a series of steps to spur construction starts, including direct public investment, with strong results. In contrast, Ontario has one of the worst housing records in Canada, missing their housing starts goal every month.

B.C. anti-speculation initiatives slowed prices and debt

The B.C. strategy could not prevent housing price increases, but did hold them far below Ontario’s rates of increase. The benchmark house price rose 74 per cent from June 2018 to March 2022 in the Greater Toronto Area, while in the Greater Vancouver area it increased 23 per cent during the same period.

The average Greater Toronto Area house price surged past the average Greater Vancouver Area price in 2021 though the Ontario price melt-down has resulted in the average Toronto prices falling an about $100,000 below Vancouver’s price. When Ford was first elected, the average Toronto home was $266,000 less than in Vancouver.

But Doug Ford is sending a $200 cheque hoping you won’t think about how much he has cost you.

If you want to better understand the housing issues today, let me explain in my podcast here:

https://open.substack.com/pub/soberchristiangentlemanpodcast/p/s2-ep-45-the-housing-shortage-deception-7d8?utm_source=share&utm_medium=android&r=31s3eo

Thankyou for this explanation!