Killing BC's public auto insurance would hike premiums, reports show

Auto insurance premiums for all tested driver profiles are substantially higher in Alberta, with some Albertans paying more than double

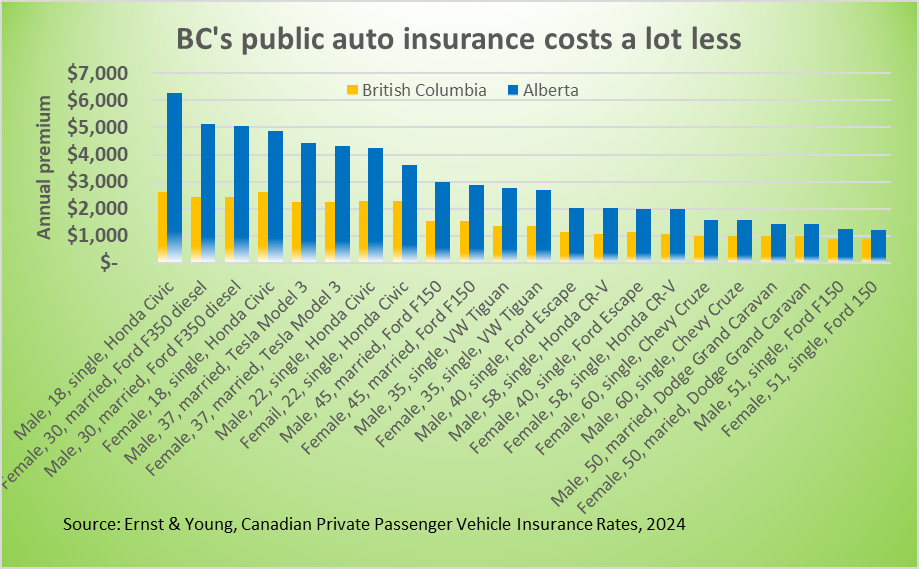

An 18 year old single male driving a Honda Civic pays a lot for auto insurance in British Columbia: $2,621.

But in Alberta, that same young man with the same vehicle, driving pattern and record would pay 140 per cent more: a whopping $6,279 a year.

An annual Ernst & Young report, updated for 2024, that surveys the cost of vehicle insurance across Canada finds residents of British Columbia, Saskatchewan and Manitoba, who have public auto insurance plan, consistently pay among the lowest premiums in Canada.

Albertans pay 37% to 140% more than in BC

For each of the 30 insurance profiles tested by Ernst & Young, the premium cost is higher than in BC, in some cases double. The smallest differential is for a 51 year old single woman driving a Ford F150, who would pay $887 per year in BC and $1,212 in Alberta, 37 per cent more.

Ernst & Young’s findings are echoed by a second 2024 report, commissioned by the government of Alberta and released by the Nous Group in April, which found adopting a BC-style public insurance system would save Alberta drivers $1.2 billion a year, an average $730 per driver.

Danielle Smith has said her conservatives have “no appetite” for a public plan.

Based on British Columbia’s population being 17 per cent higher than Alberta’s, the Nous Group estimate suggest BC drivers would pay about $1.4 billion more if rates rose to Alberta levels.

Since 2017, when the BC NDP government was first elected, until 2023, the average BC auto insurance premium has fallen 6.6 per cent, according to an analysis of Statistics Canada data by economist Jim Stanford.

During the same period, premiums under the Alberta UCP government rose 41.8 per cent, faster in Canada.

The Ernst & Young report creates 30 insurance profiles using various vehicle models, years, driving patterns and records. Then researchers priced premiums for each profile in major communities.

For provinces with multiple private suppliers, the premium charged by insurers was established and weighted to each company’s market share to determine the average premium cost of a profile in the community.

All 22 profiles created by Ernst & Young with a single driver and single vehicle are included in Data Shows’ chart, above. The additional eight profiles, which include two drivers and two vehicles, are also far more expensive to insure in Alberta than BC. They are not included in our chart due to space limitations.

If you found this post interesting, let me know by liking it!